Sales Down 18.8% and Prices Up by 5.9%

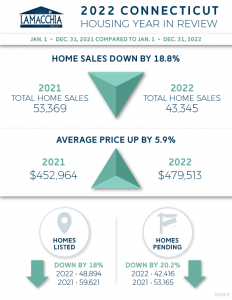

The 2022 Connecticut Year in Review Housing Report breaks down sales, new listings, new pending sales, active inventory, and average price compared to the 2021 market and analyzes what the data means for the current housing market and beyond. In 2022, there were fewer sales in Connecticut than in 2021, down 18.8% overall from 53,369 to 43, 345 in 2022. Conversely, the average price increased year over year, now at $479,513 compared to $452, 964 in 2021, a 5.9% increase.

The 2022 Connecticut Year in Review Housing Report breaks down sales, new listings, new pending sales, active inventory, and average price compared to the 2021 market and analyzes what the data means for the current housing market and beyond. In 2022, there were fewer sales in Connecticut than in 2021, down 18.8% overall from 53,369 to 43, 345 in 2022. Conversely, the average price increased year over year, now at $479,513 compared to $452, 964 in 2021, a 5.9% increase.

The market trends in Connecticut do not deviate from the real estate story being told nationally, and more of the same is expected to come in 2023, especially in regard to sales numbers. The market was bound to cool and adjust down, as the intense demand coupled with depleted inventory was unsustainable. In 2022, we saw the beginning of that market adjustment, and, as a result, inventory rose a little and the balance between supply and demand (i.e., sellers and buyers) began to restore itself. We also saw average prices slow from their aggressive ascent. This trend is expected to continue into 2023 and Anthony’s explains how this return to balance will look in detail in his 2023 predictions here.

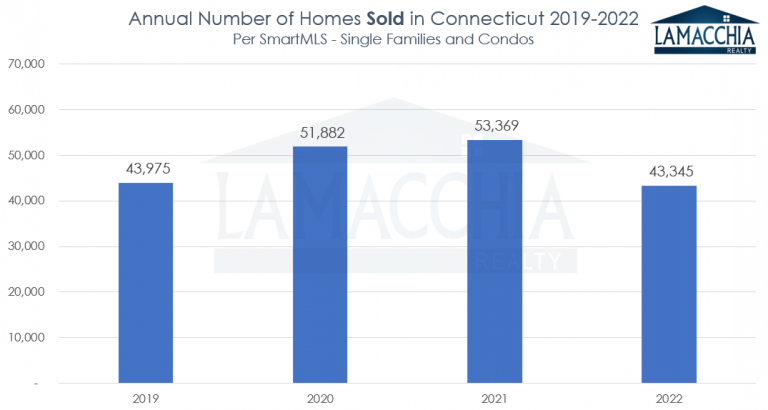

2019 – 2022 Home Sales

At the beginning of 2022, the market was still in a frenzied state as it has been since the pandemic, but when rates increased in May, the real estate market saw impacts almost immediately. Home sales were down in Connecticut 18.8%, with 43,345 sales in 2022 compared to 53,369 in 2021. It wasn’t just the adjustment that kicked off mid-22 that caused sales to drop, sales appear down in particular because we are comparing them to the number of sales in 2021, a historic year for sales nationally and it would be hard to keep up with that level. You can tell that 2022 is dropping back to slightly below pre-Covid sales levels.

Home Prices by Year

Intense demand and historically low inventory allowed prices to skyrocket to record high levels at a record high pace through 2021 and into 2022. As you can see in the graph below, prices have steadily increased in Connecticut every year since 2019. However, as soon as mortgage rates went over 5% in May 2022, many buyers exited the market as they realized the homes they wanted to be became more costly than they had anticipated, especially when home prices also continued to climb despite the rate increase. This lessened the intense demand and eased competition, allowing the buyers who were still active in the market a much-needed reprieve. Even with the lessening of demand, the average price in 2022 clocked in 5.9% higher year over year. This is proof that there is still sufficient demand in the market, so prices are expected to continue to rise, especially as more and more sellers hesitate to list their homes, but the ascent won’t be nearly as quick or as steep as we have seen over the last couple of years.

Inventory began low in 2022 as it came off the frenzied market with very high sales, and it took until rates began to rise for the number of homes on the market to also rise. The higher rates and prices began to cause buyers to hesitate to make offers and so homes began to take a little longer to sell thereby helping inventory rise slightly. More inventory gives buyers a little more leverage, which was the good side of the higher rates and prices.

Eventually, if more inventory saturates the market, prices are hopefully going to stop rising and could potentially drop a bit. Anthony explains this welcome trajectory in his predictions for 2023. Falling prices shouldn’t scare people. Real estate is a long game and market adjustments do not last forever.

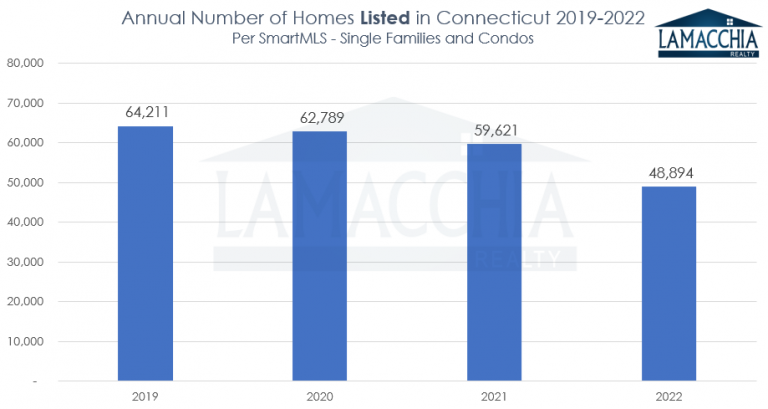

Homes Listed by Year

Listings overall for the state of Connecticut were down by 18%, decreasing to 48,894 compared to 59,621 in 2021. You can see in the graph below that listings are down substantially compared to 2019 – 2021. This drop is not surprising, however, given the frenzied nature of the market in 2021, listings couldn’t stay on the market long enough and many sellers were able to accomplish their goals of selling than with the demand so high. Additionally, many sellers are now hesitating to list their homes because of the increased mortgage rates. Sellers who purchased a home with a 2-4% [historically low] mortgage rate would now have to purchase a home with a higher mortgage rate, and this is a daunting endeavor to many sellers after being so spoiled in the post-pandemic seller’s market.

There were 20.2% fewer pending sales in 2022 compared to 2021. As seen in the chart below, there were 42,416 offers accepted in 2022 compared to 53,165 in 2021. However, this number is not one to worry over, as it is a sign of an adjusting market which is much needed. Homes are no longer flying off the market, bidding wars have lessened with that fact that buyers are now unable to make an offer as easily on a home with increased mortgage rates – all factors contributing to increasing inventory. Further evidencing this, you can see homes pending in 2022 look very similar to 2019 which was a pre-Covid market.

Nationally, sales were down and prices were up so Connecticut’s market behavior is parallel with the grander national story. Comparing an adjustment year to a historic year of frenzied sales and anemic inventory is bound the yield the results we have here. Sales down, prices up. The pace of 2021 wasn’t sustainable and put the market in the position it’s in, with a need for an adjustment back to earth. 2023 will continue down the path of this adjustment and Anthony clearly explained what that means in his 2023 predictions. The low rates have caused a dicey situation with sellers, as they’re clinging to their 2-4% rate instead of listing their homes. Most sellers become buyers, and losing that rate is the stopgap.

Sellers should list, and will inevitably if they have to. It’s just a matter of time as real estate is not just driven by opportunity. It’s also driven by need when live events change things for people such as growing family, relocation, divorce, and more. When that time comes for sellers, they should be made aware of the fact that they have options such as mortgage assumptions or Buydowns or where the first few year’s payments reflect a lower rate to help ease into an eventual higher rate.

Buyers are taking their time to save more money or perhaps rent for one more year, due to the sticker shock of the higher cost of borrowing and the rising prices. But in the end the benefits to homeownership shouldn’t be ignored. Prices are starting to lose their steam, and sellers with homes that have sat for a little while are more inclined to work together and negotiate terms to get the deal done, so now is a great time to get in the market before the spring rush. Get in and get out before the competition heats up and multiple offers become prevalent again.

Once the deal is done, homeowners are essentially paying themselves, and the peace of mind is priceless; paying your own mortgage instead of the landlord’s, the tax benefits, seeing your equity rise as time goes on, and the ability to control your domain are all key benefits among many. If getting in the market is on your radar, now is the time to get prepared with an expert REALTOR to get started off on the right foot.

*Data provided by SmartMLS