The Lamacchia Realty South Florida Housing Report presents overall home sale statistics and highlights the average sale prices for single families, condominiums/townhomes in Broward County, Miami-Dade County, and Palm Beach County for December 2022 compared to December 2021. It also looks at other metrics like New Listings and New Pending Sales as they are often the best indicators for predicting future trends in the market.

The Lamacchia Realty South Florida Housing Report presents overall home sale statistics and highlights the average sale prices for single families, condominiums/townhomes in Broward County, Miami-Dade County, and Palm Beach County for December 2022 compared to December 2021. It also looks at other metrics like New Listings and New Pending Sales as they are often the best indicators for predicting future trends in the market.

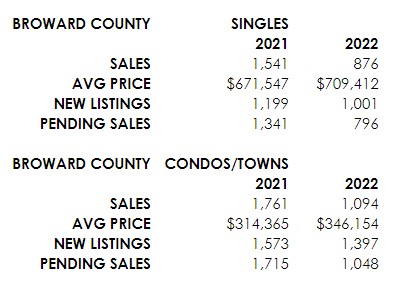

Broward County

In December of 2022, Broward County single-family and condo/townhome closed sales, new listings, and pending sales decreased. The average price increased for condos and townhomes and single-family homes.

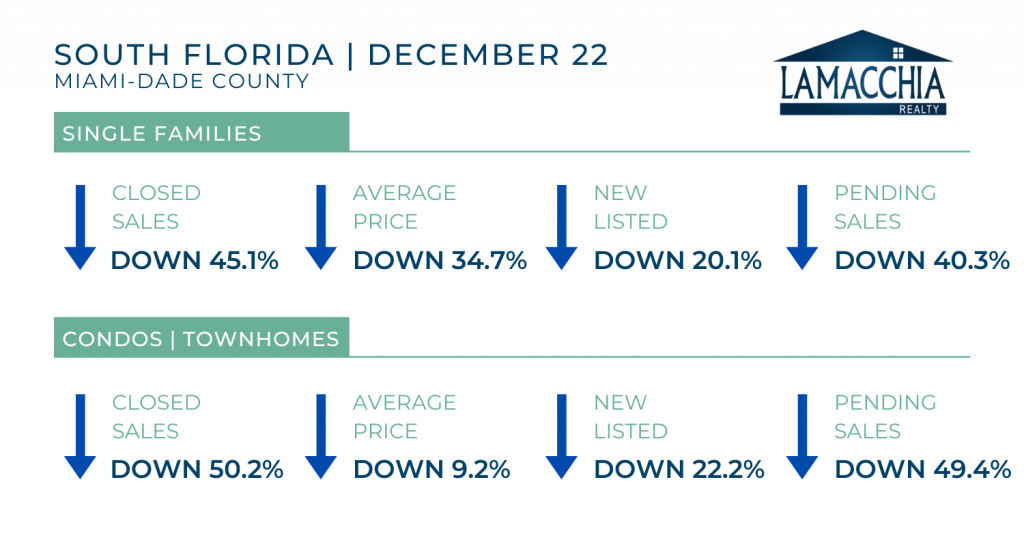

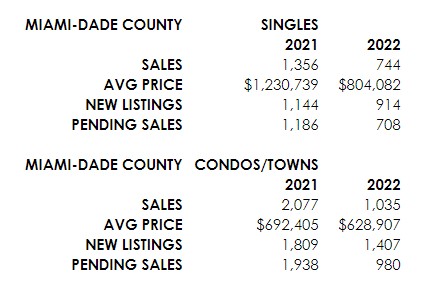

Miami-Dade County

In December of 2022, Miami-Dade single families and condos/townhomes saw decreases in all categories.

Palm Beach County

In December of 2022, Palm Beach County single families and condos/townhomes saw a decrease in all categories, besides a slight increase in average price for condos and townhomes.

Highlights

- The South Florida December housing data paints a perfect picture of the cooldown being experienced in the housing market, not only in South Florida, but nationwide – with sales, new listings and pending sales being significantly down in all categories in all three counties when compared to December 2021.

- As the South Florida market continues to shift down in 2023, sales are expected to stay lower when compared to 2022, especially since rates have remained at around 6%. Increased rates impact buyer affordability, taking many out of the market complete thus lessening demand. Specifically, for South Florida, increased rates deter many 2nd home homebuyers from entering the market as their disposable income cannot cover the mortgage payment at these increased rates versus when rates were historically low.

- Buyers, there are mortgage options available, such as a buydown or assumption, that could allow you to purchase a home at or with a lower mortgage rate and, therefore, a lower monthly payment.

- Usually, decreased in sales are not as notable in South Florida given the prevalence of cash buyers in the area, but in this cooling market, those transactions are no longer keeping sales numbers afloat.

- Average prices increased in some counties, but we also say average prices decrease in the other counties which deviates from the usual upward trajectory we have been seeing since the start of the Covid pandemic. South Florida saw an influx of demand at the start of the pandemic causing prices to skyrocket, but current economic and market factors are lessening that demand and brining prices down as a result. Price appreciation is expected to flatten as we head into 2023.

- Other factors impacting demand and affordability in the South Florida region include return to work mandates, strict condo regulations enacted as a result of the tragic Surfside Collapse as well as property insurance premiums rising. Luckily, two new insurance reform bills were just recently passed to hopefully provide some relief and stability to the property insurance market.

- Sellers, if you are thinking about listing your home, now is the best time to get your home on the market! There are serious buyers in the market NOW and the longer you wait, more inventory will be added to the market which means you most likely will not be able to sell your home for as much as you would have been able to within these next few months.

- Changes to condo regulations and the subsequent spike in HOA fees are going to likely incite a wave of condo listings in the spring. If selling your Florida condo is on your radar, now is the time to do so to take advantage of the low condo inventory and motivated buyer demand.

- As we head into 2023, we will continue to see the market adjust. Anthony reviews market data and further explains the outlook for 2023 in his 2023 Predictions here.

*Data provided by Florida Realtors® SunStats