January Home Sales Down Nearly 36% in Northeast

“We are experiencing a classic economic overcorrection in the housing sector with respect to the number of sales. We had a big boom in housing after Covid hit, and now we have the hangover that is getting worse due to rates recently going back up as I said they would in my 2023 Predictions. March is next week so things will undoubtedly pick up. It’ll likely be summer when we finally see home sale numbers get closer to last year’s, as the beginning of 2022 exhibited sales numbers too high for 2023 to compete with. This too shall pass.” – Anthony Lamacchia, Broker/Owner

-

- The New England housing market is off to a slow start in 2023, with home sales down about 30% in January 2023 compared to this time last year. The market is usually slow to start in the beginning of the year given normal seasonality, but this year consumers are also faced with increased mortgage rates and inflation which means overall buying power is diminished. Listen to Anthony talk about the current housing market in more detail on Boston25 morning news here!

- Nationally, the National Association of REALTORS® (NAR) reports that existing home sales are down 36.9% over this time last year from 6.34 million to 4.00 million (seasonally adjusted annual rate).

- As mentioned, mortgage rates continue to play a huge role in the market adjustment we will continue to see in 2023. Rates stayed in the low 6s throughout January but have started creeping back up in recent weeks. Preapprovals will have to be updated more frequently to contend with continuously changing rates until they begin to level out.

- Increased rates reduce buyer affordability, especially with the price of everything else going up at the same time, so many buyers were forced to exit the market and haven’t been able to re-enter. As a result, sales have been down, but should start to pick back up as we head towards late spring/summer as both buyers and sellers adjust their budgets and/or expectations.

- Additionally, listings and pendings are down from January 2022 as many ‘would-be sellers’ are choosing to stay in their current home with a low mortgage rate (e.g., 2-3%). Most will either renovate or expand their homes rather than sell.

- In this ever-evolving economic climate, staying informed and knowing all your options is key! There are several mortgage options available to allow buyers to purchase a home at a lower-than-current rate, such as mortgage assumptions or buydowns.

- Sellers, there are benefits to working with a buyer using the mortgage options described above. Remember, the value of your home has most likely gone up, and the equity you have built will be wildly beneficial when selling your home. The key to selling your home quickly and for the most money will be pricing your home competitively for this current market.

- Average prices have increased slightly year over year, as predicted, even with increased mortgage rates and increased inventory (i.e., less demand, more supply). Nationally, the median sale price for existing home sales per NAR in January of 2023 was $359,000, which is up only 1.3% over last January’s $354,300. This trend is expected to continue as we head further into 2023, and we may even see prices go down year over year in some markets.

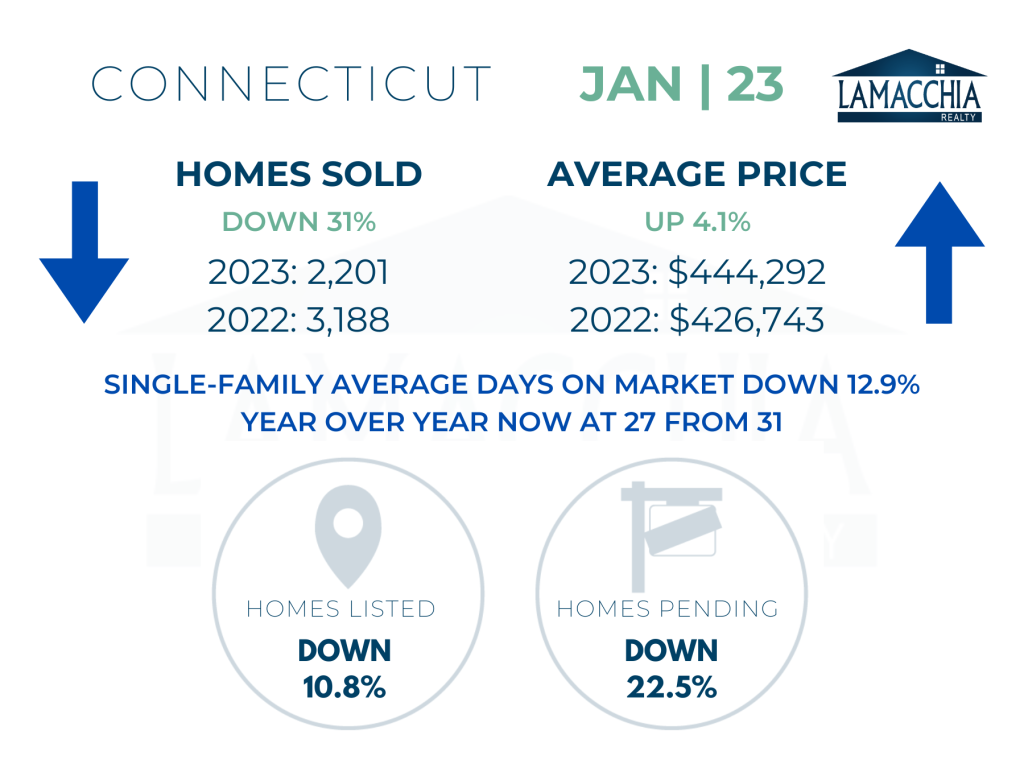

CONNECTICUT

Home Sales Down 31%

Single-family and condo home sales have both decreased overall by 31% when compared to January 2022.

- Single families: 2,469 (2022) | 1,688 (2023)

- Condominiums: 719 (2022) | 513 (2023)

Prices overall have continued to increase, now up 4.1% to $444,292 compared to January 2022. Prices increased in every category.

- Single families: $472,807 (2022) | $484,709 (2023)

- Condominiums: $268,627 (2022) | $311,460 (2023)

Homes Listed For Sale:

The number of homes listed is down by 10.8% when compared to January 2022.

2023: 2,520

2022: 2,826

2021: 3,558

Pending Home Sales:

The number of homes placed under contract is down by 22.5% when compared to January 2022.

2023: 2,357

2022: 3,041

2021: 3,574