July Highlights

- Mortgage rates and inventory levels continue to shape the housing market landscape as we continue through the summer months. Home sales are down once again in the month of July, and homes listed is also down when compared to this time last year.

- In fact, the number of homes listed in the first half of 2023 is the lowest in recorded history, keeping inventory extremely tight.

- In July 2023, mortgage rates jumped back and forth between high 6%s and over 7%. However, as we head towards the Fall months, mortgage rates are expected to continue their trend upward, most likely hitting 8% around September.

- With that said, serious buyers should be ready to strike with updated preapprovals and be informed about their mortgage options, including buydowns and assumptions, to ensure that they can be successful in this market.

- There are still many would-be sellers who are hesitant to list their homes given current mortgage rates as many have low 2-3% mortgage rates from when they bought during the pandemic. This scenario is keeping listings down significantly, and inventory is squeezed as a result and cannot keep up with the buyer demand in the market.

- Important to note that these conditions would normally lead to an increase in prices. However, this year factors such as increased mortgage rates and inflation are straining overall consumer affordability which will keep housing prices from soaring.

- For sellers who cannot wait to list their homes due to changes in life circumstances (e.g., career change, growing families, divorce, etc.), there are several steps that you can take to make sure your home attracts the most buyers as the more demand you can create, the more leverage you have to better dictate terms. This is even more essential for those who may be buying and selling at the same time.

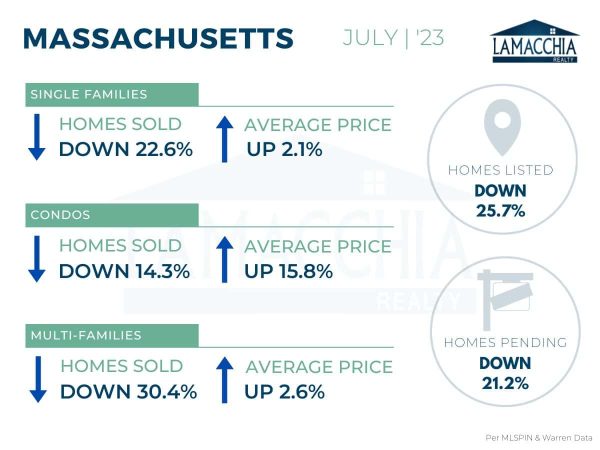

MASSACHUSETTS

Combined Home Sales Down 21%

Combined sales are down 21% year over year, with July 2023 at 6,447 compared to 8,164 last July. Sales are down across all categories.

- Single families: 5,279 (2022) | 4,085 (2023)

- Condominiums: 2,201 (2022) | 1,886 (2023)

- Multi-families: 684 (2022) | 476 (2023)

Combined average prices have a year-over-year increase of 5.5%, now at $737,903 compared to $699,660 in July 2022.

- Single families: $734,372 (2022) | $750,023 (2023)

- Condominiums: $625,904 (2022) | $724,678 (2023)

- Multi-families: $669,102 (2022) | $686,294 (2023)

Homes Listed For Sale:

The number of homes listed is down by 25.7% compared to July 2022, would-be sellers are concerned about jumping into the market.

- 2023: 6,153

- 2022: 8,285

- 2021: 9,557

Pending Home Sales:

The number of homes placed under contract is down by 21.2% when compared to July 2022.

- 2023: 5,620

- 2022: 7,135

- 2021: 8,416

Price Reductions:

The number of price reductions is down 47.5% when compared to July 2022. Sellers, pricing your home right is crucial in this market.

-

- 2023: 415

- 2022: 790

- 2021: 679

Data provided by Warren Group & MLSPIN then compared to the prior year.