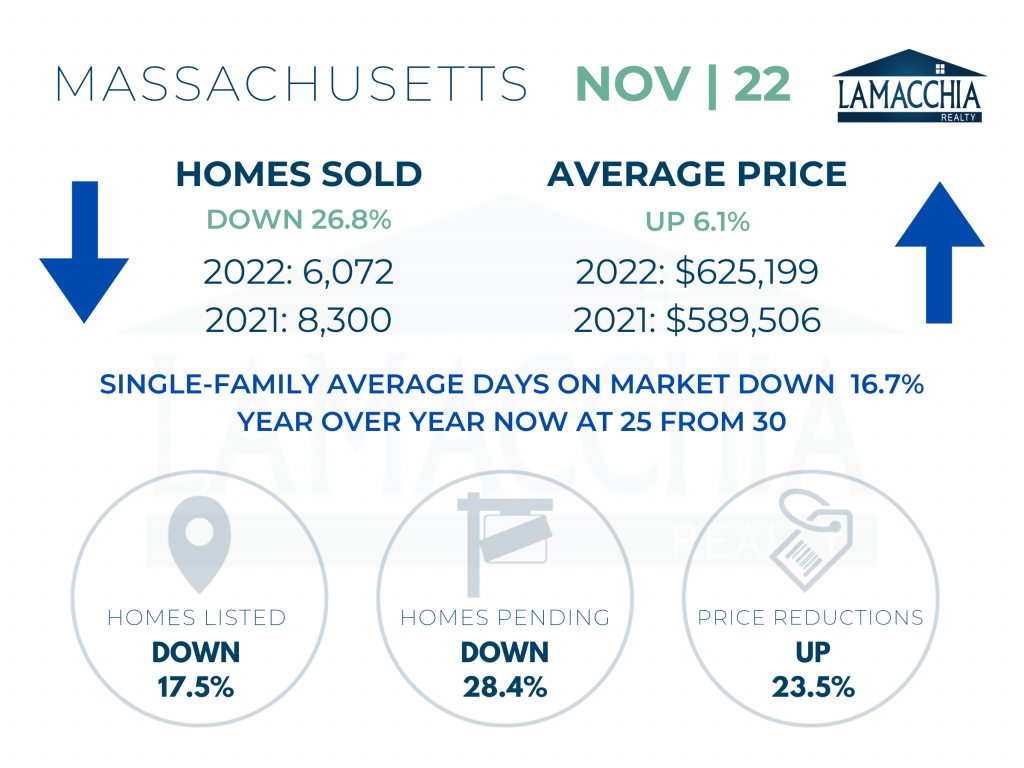

Massachusetts Home Sales Down 26.8%

Sales are down 26.8% year over year, with November 2022 at 6,072 vs. 8,300 last November. Sales are down across all categories.

- Single families: 5,366 (2021) | 3,806 (2022)

- Condominiums: 2,114 (2021) | 1,663 (2022)

- Multi-families: 820 (2021) | 603 (2022)

Average prices have continued their rise with another year-over-year increase of 6.1%, now at $625,199. Prices increased in every category.

- Single families: $635,922 (2021) | $686,067 (2022)

- Condominiums: $461,956 (2021) | $496,016 (2022)

- Multi-families: $683,035 (2021) | $688,252 (2022)

Homes Listed For Sale:

The number of homes listed is down by 17.5% when compared to November 2021.

- 2022: 4,943

- 2021: 5,993

- 2020: 6,360

Pending Home Sales:

The number of homes placed under contract is down by 28.4% compared to November 2021, which indicates sales next month and the beginning of 2023 will likely fall.

- 2022: 5,362

- 2021: 7,485

- 2020: 7,638

Price Reductions:

The number of price reductions is up 23.5% when compared to November 2021. Sellers who haven’t attracted much interest to their listing in 30 days (especially with the reduction of rates over the month of November) are urged to consider adjusting their price. If rates are increasing buyer affordability and they’re still not making offers, an adjustment is likely the next best step.

- 2022: 509

- 2021: 412

- 2020: 494

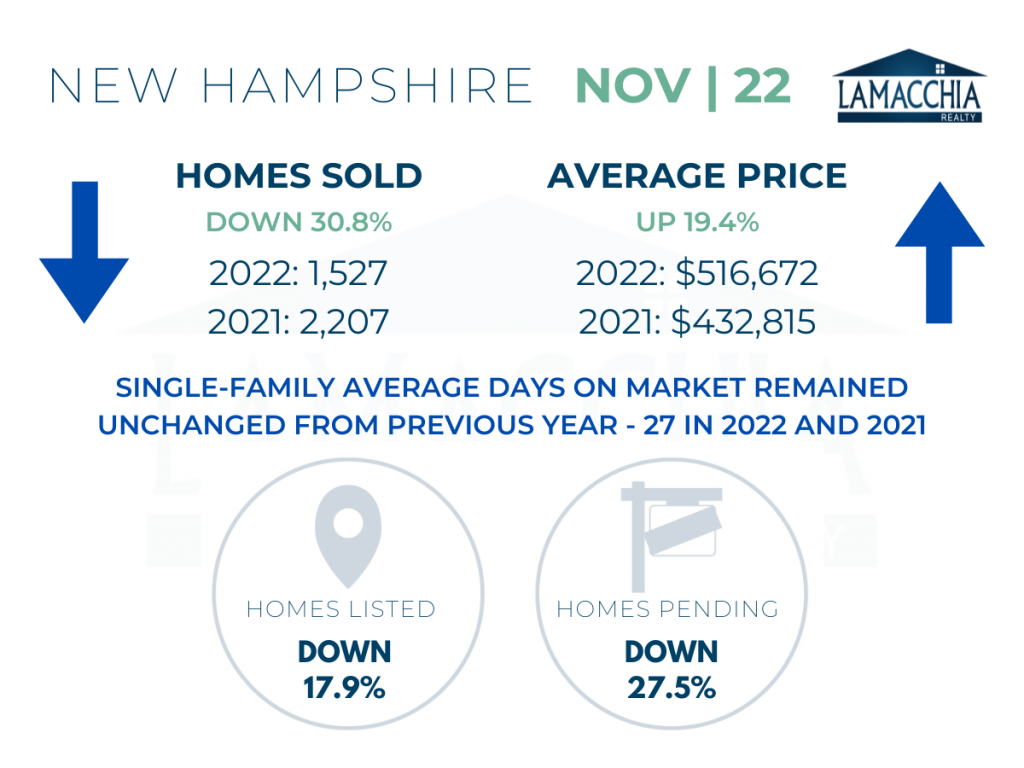

New Hampshire Home Sales Down 30.8%

Single-family, condo home sales, and multi-family home sales have decreased overall by 30.8% compared to November 2021.

- Single families: 1,578 (2021) | 1,091 (2022)

- Condominiums: 480 (2021) | 342 (2022)

- Multi-families: 149 (2021) | 94 (2022)

Prices overall have continued to increase, now up 19.4% to $516,672 compared to November 2021. Prices increased in every category.

- Single families: $460,865 (2021) | $550,248 (2022)

- Condominiums: $347,759 (2021) | $415,973 (2022)

- Multi-families: $409,755 (2021) | $493,348 (2022)

Homes Listed for Sale:

The number of homes listed is down by 17.9% when compared to November 2021.

- 2022: 1,256

- 2021: 1,530

- 2020: 1,680

Pending Home Sales:

The number of homes placed under contract is down by 27.5% when compared to November 2021. Sellers who haven’t attracted much interest to their listing in 30 days (especially with the reduction of rates over the month of November) are urged to consider adjusting their price. If rates are increasing buyer affordability and they’re still not making offers, an adjustment is likely the next best step.

- 2022: 1,350

- 2021: 1,862

- 2020: 2,011

Highlights

- Listings are down in November, which can be attributed firstly to normal seasonality within the market. However, we are now seeing more sellers hesitate to list their homes to avoid losing their low ‘covid-era’ mortgage rate. Many will remodel or put on additions to their current home rather than buy another to fit their current needs.

- Rates dropped into the 6s in early November and have hovered there since. Regardless, the affordability of many buyers is still negatively impacted by the higher rates, as well as still rising home prices. Therefore, many are unable to enter the market at all, resulting in sales being down year over year.

- Prices, and therefore values, are still rising and are expected to continue to do so as we near the end of 2022. However, in late November, the FHFA announced the new, higher loan limits for 2023 to better align with current market conditions.

- Pending home sales are also down in November, indicating that sales will be down again in December and early into 2023.

- Sellers, homes do sell during the holidays! Buyers in the market during the holiday season are typically extremely motivated to complete the transaction as soon as possible, especially those that come out right after the new year. There are several ways to properly prepare your home for a winter sale, but ultimately, you want to make sure you are pricing your home right based on current market conditions

- Buyers, don’t be discouraged by mortgage rates; many options are available to get you into your home. Remember, there is a cost to waiting, so being informed and knowing all of your options is key! Click to learn more about all mortgage options, including Buydowns, adjustable rate mortgages, and more, which could get you into a home at a lower-than-current rate.