An assumable mortgage is a mortgage that allows a buyer to purchase a home and assume a seller’s existing low-rate mortgage rate. Learn more in the video below:

How Can a Mortgage Assumption Help Me?

SELLERS

What’s in it for me?

- Marketing edge

- Sell for more

- Negotiating power

Allowing buyers to assume your current mortgage (and low rate) will help you sell faster and often for a higher price. In fact, buyers are willing to pay more to obtain a lower interest rate since this will save them money in the long run. In the instance of a fully executed assumed mortgage transaction, you will be released from the loan and will no longer be held liable.

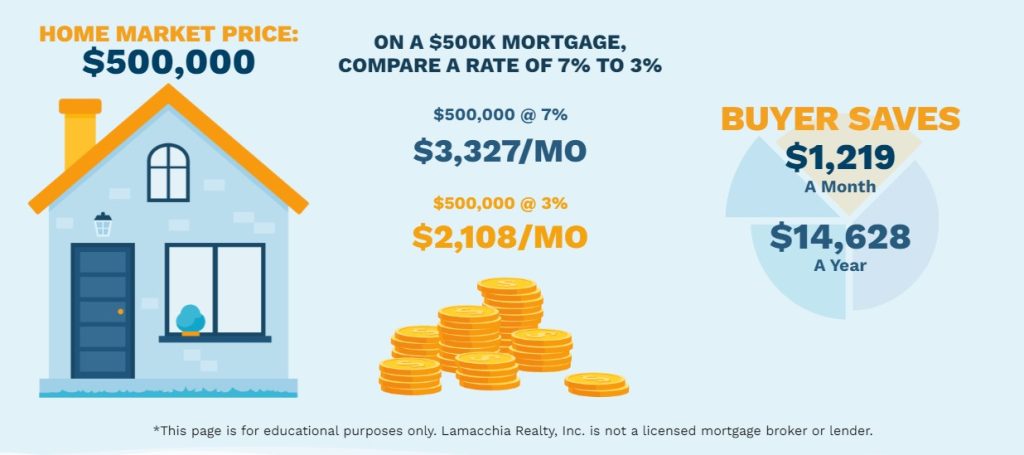

Imagine there are two homes for sale for the same price and one is offering a 3% mortgage assumption vs a 7% traditional sale at the current market rate. That’s a savings of approximately $1,219 monthly for the average home buyer if the home value was $500,000. Which do you think the buyer would want?

BUYERS

What’s in it for me?

- Lower rates

- Fewer closing costs

- Smaller monthly payment

- Pay off mortgage sooner

- Long term savings

- Permanent unlike a Buydown

This program will help homebuyers obtain mortgages with historically low rates that are now behind us and impossible for buyers to get with a new mortgage.

By obtaining a lower interest rate you can potentially save hundreds of thousands of dollars over the life of the loan! You also save money on normal closings cost associated in purchasing a home.

Example of a Mortgage Assumption

Are ALL Mortgage Types Assumable?

With FHA/VA/ USDA mortgages its actually written into the mortgage documents that its allowed so its most common with those mortgage types. But other loan types could qualify.

How Do I Qualify for an Assumable Mortgage?

The application process is similar to the standard mortgage application process in that an application will need to be submitted along with documentation to support your income and employment status, tax returns, proof of assets, credit score, proof of down payment funds, etc.

**Lamacchia Realty, Inc. is not a licensed mortgage broker or lender. The information on this website is for illustrative and educational purposes only and is not intended as an offer or solicitation for any mortgage product or any financial instrument. Consult with a licensed mortgage broker or lender for specific loan products and for more information about underwriting guidelines, interest rates, borrower qualifications, and other requirements you may need to meet to qualify for a mortgage loan or a loan assumption.**