Sunny Florida has its obvious perks to residents including the weather and therefore the lifestyle, and it’s never surprising to see people relocate there and it’s been going on for decades. A post-Covid phenomenon, however, is how much it increased that people are fleeing high tax areas in states like New York, California, Seattle, New Jersey, and Massachusetts to the refuge of Florida’s lower cost of living.

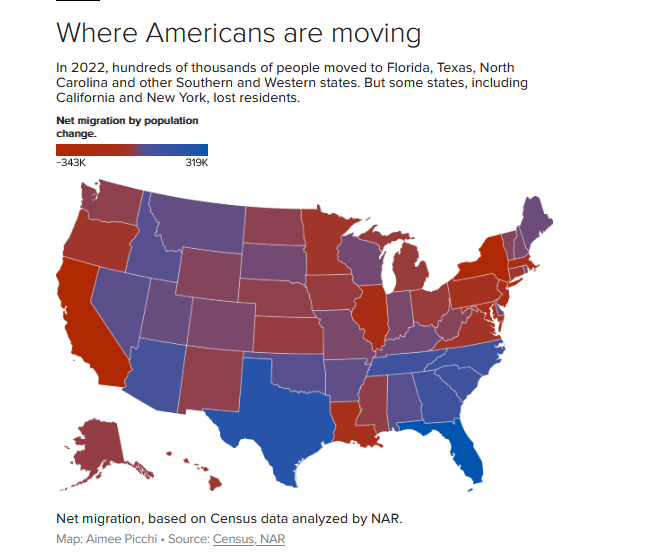

Florida ranked highest net domestic migration last year (2022), with about 319,000 people migrating into the state, an NAR analysis found. California was the biggest loser in net loss migration, with 343,000 leaving the state for other regions. “Florida was the fastest-growing state in 2022, with an annual population increase of 1.9% within a year. In fact, that was the first time since 1957 that Florida’s population grew faster than anywhere else across the United States,” stated NAR.

Below, the Net migration map depicts states ranging from red with the most loss in population to blue states with the highest population gains in 2022.

Interactive version of this map here: https://www.cbsnews.com/news/states-where-americans-are-moving-florida-texas-north-carolina-south-carolina/

Weather

Depending on where in Florida you end up calling home, the weather is typically warmer and with almost the entire perimeter of the state on the coast, views and water access are one of the many perks. Energy costs are often lower for primarily air-conditioned environments as opposed to areas also requiring heat, which is costly.

Regions of Florida

Florida is broken up into 8 regions including the Panhandle, North Central, North East, Central Western, Central, Central Eastern, South West, and South Florida. While they all share common features, lifestyle, and climate varies from area to area. Colleges and universities, the Gulf coast or Atlantic, up north towards the Panhandle has more weather seasons, while closer to South Florida it feels like summer year-round. Sports enthusiasts will enjoy college and professional sports, golfing, and boating, while fans of wildlife will target areas near the Everglades and national parks. While transplants will opt to put new roots down in one region, they have the ability to visit the vast range of areas in Florida to experience all the state has to offer.

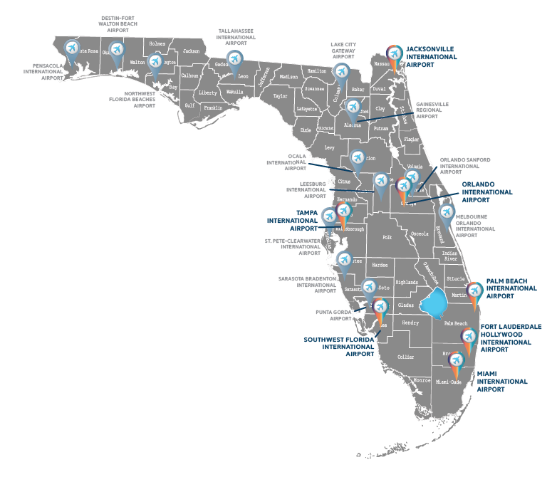

Travel

Often those moving to Florida choose areas near airports that offer direct flights from their original home so that they’re just a single flight away should the need arise for a visit. While the state boasts many airports, some of the more well-known airports include Jacksonville International Airport, Orlando International Airport, Palm Beach International Airport, Fort Lauderdale International Airport, Miami International Airport, Southwest Florida International Airport, Tampa International Airport.

Lifestyle

Snowbirds have often landed in Florida due to a slower, more relaxed lifestyle that offers warmth and more time for leisure and recreation. Golf, boating, outdoor enjoyment, beaches, pools, and shopping are all activities more often enjoyed in the Sunny state. COVID mandates sped this migration trend up as most people were at that point working from home and figured that doing so from a warm patio in a home potentially less expensive than where they originated just made good sense. Work scenarios evolved and with the lower rates and government stimulus, moving to a state with a lower cost of living and an enhanced lifestyle was a no-brainer.

“In the 2022 study, 38% of United Van Lines movers to Florida relocated for retirement. The second highest reason? Lifestyle change at 28%. These were the top two reasons in 2021 as well.” Stated Florida Realtors. The Boston Globe reported recently that 110,000 Massachusetts residents migrated to Florida since the start of Covid.

Taxes

Florida, unlike many states, doesn’t have a personal income tax, so those who are getting paid either aren’t getting wages withheld from an employer, or self-employed taxpayers don’t have to account for that payment.

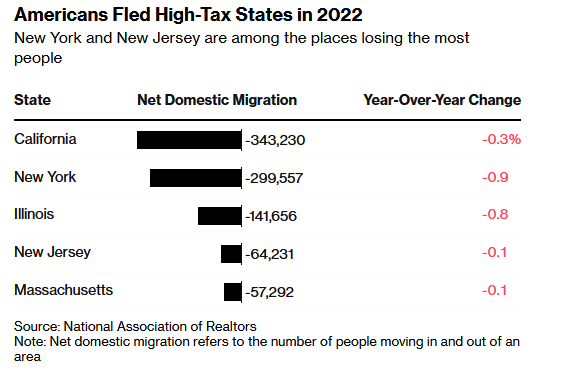

In the chart below, it’s clear that high-tax states are enduring high out-migration rates, with California, New York, Illinois, New Jersey, and Massachusetts being the top five areas with the most population loss.

”Notably, people who leave New York typically save 15x more from lower housing costs than from tax savings, an analysis from the Fiscal Policy Institute found.” Stated ZeroHedge

On the flip side, Florida, Texas, North Carolina, South Carolina, and Tennessee (in that order) were the states with the highest inbound relocation rates. Weather, lifestyle, low taxes, and as well, the job market are all key factors in these states’ popularity.

High-income earners migrating out due to new Millionaires’ Tax

In November of 2022, Massachusetts voters approved a 4% “Millionaire’s Tax” on those with annual incomes of over $1 million which will be added to the state’s current income tax of 5%. This is likely to impact 0.6% of Massachusetts households but less if residents with high income opt to leave the state to avoid the surcharge.

“Moving to another state can eliminate Massachusetts income tax entirely, except on Massachusetts-source income, which includes income from a Massachusetts-based business (including employee compensation and flow-through subchapter S income or partnership/LLC income from a Massachusetts business) and income from real property located in Massachusetts.” Noted MorganLewis.com

The sting tax, which is levied on S corporation owners, is layered on top of individual income tax and is unique to Massachusetts. Most people are unaware of this additional tax because it only impacts businesses with larger revenues. “An S corporation’s income, losses, and deductions are passed through to the shareholders and are reported and taxed on the shareholders’ individual returns,” according to Mass.gov. These owners therefore will now pay the 5% individual income tax, the 4% millionaire’s tax, and, depending on revenue, up to 4% for the sting tax. If you add all these together, that’s 13% in additional taxes for business owners with high incomes to stay in Massachusetts but if they move to Florida all that goes away. Bottom line it’s costly to own a profitable business in Massachusetts.

It’s not just residents and business owners of Massachusetts origin that are migrating to the more cost-effective sunshine state. Ken Griffin, owner of Citadel Securities, a $51 billion hedge fund headquartered in Chicago is relocating to Miami for reasons cited such as taxes, crime, and weather.

Business

Individuals and families have been moving to Florida for years for the weather, lifestyle, and taxes; this isn’t a new phenomenon. But what is a new trend, especially since Covid, major companies have relocated their operations down to Florida and when that happens, a percentage of their employees are part of the migration.

“Miami, for instance, has had success in securing major offices for startups and international companies. In the past 19 months, 122 companies have either expanded or opened main or regional headquarters within city limits, according to figures released by Venture Miami, an economic initiative affiliated with the office of Mayor Francis Suarez. Those companies are currently employing 6,249 people with full-time positions and they’re projected to create another 11,778 full-time posts in the future,” reported the Business Development Board of Palm Beach County.

South Florida has seen incredible population growth. Miami is now calling itself the “Tech Hub of the South.” NBCUniversal is building its largest amusement park U.S. theme park Epic Universe in the next couple

Outbound states to FL

New York in 2022 experienced a “staggering exodus” as more residents, 67,577 to be exact, left for sunny Florida than any other year in history, according to a New York Post article. There were 61,728 New York residents who left in 2021. Driver’s license exchanges from the Florida Department of Highway Safety and Motor Vehicles accounted for this number. High taxes and rising crime were cited as the two most predominant reasons.

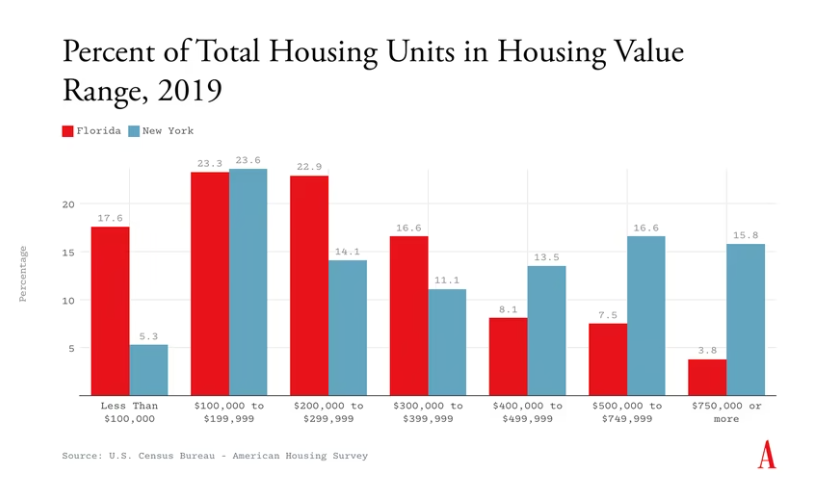

“Although many commentators attribute the shift in migration preferences to taxes—one recent Bloomberg article frames the NAR data in this manner—what’s largely driving the trend is housing costs. In fact, Census Bureau survey data consistently show that people move primarily for housing-related reasons, followed by family- and job-related reasons.” Stated the Atlantic in a recent article.

“Unquestionably, stratospheric housing costs are a major factor in why people leave Massachusetts, especially now. Before the pandemic, a family making $100,000 a year could afford to buy 37 percent of homes available in the state. Today that figure is just 12 percent. In metro Boston, it’s just 6 percent, compared with 34 percent nationally.” Stated Bloomberg Government

States need less expensive housing to attract people or entice people to stay. The problem is Massachusetts Lawmakers, and most municipalities continue to implement things that make it both harder and more expensive to build such as overly burdensome energy rules, and building permitting processes that get harder and harder to navigate.

High housing and tax costs intended to bolster state revenue end up having the opposite effect as the high cost of living ends up potentially causing population loss, and therefore decreased tax revenue. The revenue loss ends up causing local and state programs [like trash collection and public school support] to be cut which even further causes population outmigration.

As it stands, in the chart above, it’s clear that Florida, along with no income tax, also offers many more affordable housing units which are more easily purchased by first-time home buyers and those with limited budgets. Florida, therefore, attracts those of any wealth sector, with perks ranging from no millionaires tax to more homes at more affordable price ranges.

We are hearing directly from people in high-cost areas that they prefer FL living due to a more flexible lifestyle, the lower cost of living, and taxes. They have been serving transplants and relocations for years to the area, helping people achieve their vision of living with a more affordable, sunnier, more flexible lifestyle.